Owning a bike in the UK gives you freedom, fitness, and a cheaper way to travel. But it also comes with risks. Cycle theft has risen as cycling has become more popular. Each year around 77313 bikes are reported stolen in the UK. Add the chances of road accidents and liability claims cycling insurance has become essential.

Insurance protects your bike and shields you from unexpected costs. In this guide you will learn exactly what Cycling UK insurance covers. Will know how much it costs and why it is worth considering for every rider.

Why Cyclists in the UK Need Insurance

Just like the licence law there is no legal requirement to insure your cycle in the UK. Riding without insurance can save money upfront but it leaves you exposed. There are many reasons why cyclists choose to insure their bikes:

Theft

The number of reported stolen cycles in the UK is high every year. Thieves mostly target city centres, train stations, and bikes left with weak locks.

High Replacement Costs

A basic bike can cost £300–£500 but quality ebikes mostly run between £1000-£2000. Paying that out of pocket is tough for most riders.

Liability Risks

If you accidentally hit a pedestrian, scratch a parked car, or collide with another cyclist you could face thousands in claims. Liability insurance protects you with cover up to £5 million.

Personal Safety

Cyclists are vulnerable on the road. An accident leads to hospital bills, physiotherapy, and even loss of income. Insurance helps cover these costs.

Peace of Mind

Cycle insurance gives you peace of mind. You can travel and ride without constantly worrying about “what if.”

Types of Cycling Insurance in the UK

Cycling insurance in the UK is not the same for all sizes. You can choose different types of cover depending on your needs.

1. Theft and Damage Cover

Cycling UK insurance protects your bike against:

-

Theft at home or outdoors with approved locks

-

Vandalism

-

Accidental damage such as crashes or falls

Many policies also offer new for old replacement if your bike is less than three years old and was bought new.

2. Cyclist Liability Cover

This protects you if you cause an accident. For example:

-

Knock over a pedestrian

-

Damage a parked car

-

Collide with another cyclist

Cyclist liability coverage can go up to £5 million. So it gives strong protection.

3. Personal Accident Insurance

It covers serious injuries such as broken bones, disability, or even death. Some policies include payouts up to £50000.

4. Accessories Cover

If you are carrying high-value items you need this cover. It protects items such as helmets, locks, lights, panniers, and GPS devices. Usually it covers up to £1000.

5. Loss of Earnings Cover

With this cover, you will get weekly payments if you cannot work due to a cycling accident.

6. Worldwide or Competition Cover

For cyclists who travel abroad or take part in races. Standard UK policies usually only cover domestic riding unless upgraded.

What Is Typically Covered In Cycling UK Insurance

Most UK cycling insurance policies cover:

-

Theft, loss, and accidental damage to bikes

-

Replacement bike hire when yours is being repaired

-

Liability up to £5m

-

Personal accident benefits

-

Accessories and clothing

What Is Not Covered

Insurance has some exclusions. Common ones include:

-

Theft without proof of using an approved lock.

-

If you leave your bike unsecured in public.

-

Lack of ownership proof such as a receipt or serial number.

-

If you have used your bike for courier work or carrying passengers.

-

The bike is used for competitive racing but is not specifically added in the policy.

-

Claims policy outside the UK without worldwide cover

Are You Already Covered?

If you have already insured check what is included in your existing policies. So, before buying cycling UK insurance check:

-

Home insurance: Sometimes home insurance covers bikes. But it usually covers the bike if it is only stored at home. Excluded when you are out riding.

-

Travel insurance: It offers limited cycle protection abroad. But mostly excludes e-bikes.

-

Cycling memberships: Organisations like Cycling UK and British Cycling include liability insurance for members but not theft or damage.

Understand these gaps so you don’t pay for duplicate cover. It also helps to avoid risky blind spots.

How Much Does Insurance Cost in the UK?

The cost of a cycle insurance in the UK depends on several factors:

-

Value and type of bike

-

Your age and location

-

Where the bike is stored (garage vs outdoors)

-

Add ons such as competition or worldwide cover

Average Premiums

-

Standard road or hybrid bike: £3–£25 per month

-

High-value mountain bike or e-bike: £15–£30 per month

-

Comprehensive cover with extras: £35+ per month

How Can You Make a Claim

If you need to claim on your policy report theft or damage to the police and get a crime reference number. Then contact your insurer with your policy number. Provide proof of ownership such as a receipt, photos, or a serial number.

You will also need to submit repair estimates or replacement costs. Also keep damaged parts or locks as evidence. Quick reporting and complete documents will speed up the process.

Best E-Bikes for Insurance in the UK

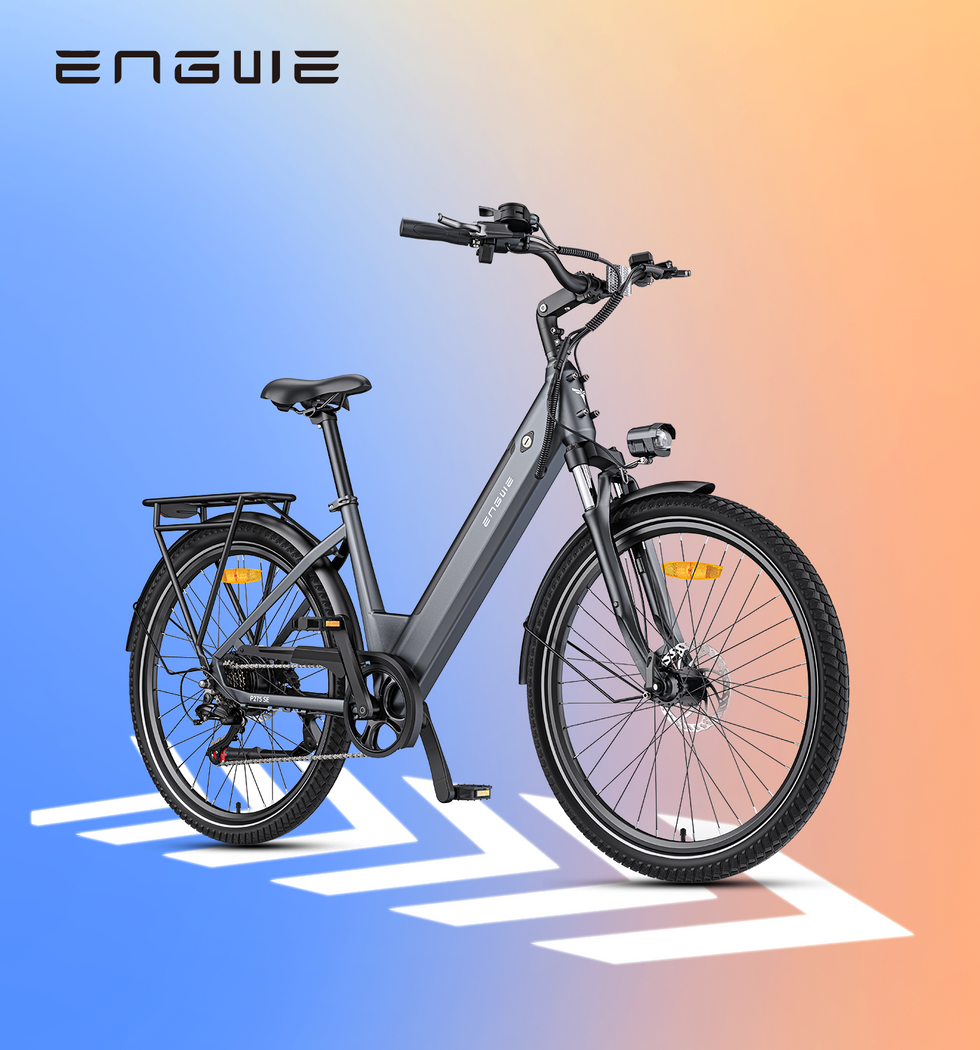

E-bikes are popular across the UK for their power, range, and versatility. Trusted brands such as Engwe provide models like EP-2 Pro, Engine Pro, and L20 are perfect for city commutes and countryside rides.

With higher price tags they are prime targets for theft. Without insurance losing your E-bike could cost you over £1000. For Engwe riders cycling UK insurance is a smart protection for your investment.

Engwe EP-2 Boost

The EP-2 Boost is a foldable fat-tire e-bike built for city commutes and weekend adventures. With its powerful motor and compact design, it’s both practical and valuable. For this insurance is essential to protect against theft or accidental damage.

Engwe Engine Pro 2.0

The Engine Pro 2.0 is Engwe’s flagship model. It is equipped with a strong motor, a long range and advanced suspension. Its higher price tag makes it a prime target for thieves, so comprehensive insurance is the smart way to safeguard your investment.

Engwe L20

Engwe L20 blends comfort and utility with a step-through frame and wide tires. It is perfect for daily errands and commuting. Because it is often parked outdoors, insurance gives L20 riders peace of mind against theft and everyday mishaps.

YouTube Video Link:

Tips for Choosing the Right Cycling Insurance

-

Check the value of the policy. Make sure your policy covers your bike’s full replacement cost.

-

Read exclusions carefully. Understand security requirements for locks and storage.

-

Consider liability cover. It is essential if you ride in busy areas.

-

If you use expensive helmets, lights, or panniers then don’t forget to add an accessories cover.

-

If you own more than one bike look for multi-bike discounts.

-

Do not overlook e-bike specifics. Make sure your insurer covers electric bikes as some do not.

Final Thoughts

Cycling UK insurance is not mandatory, but it is increasingly important for modern riders. Theft, accidents, and liability claims can create serious financial strain. The right policy means you can focus on enjoying your rides. With comprehensive cover in place, you can ride with confidence. Knowing that if the unexpected happens, you’re fully protected. For Engwe owners, whose e-bikes are both valuable and desirable to thieves, insurance offers essential protection.

FAQs on Cycling UK Insurance

What does cycling insurance personal injury cover?

Cycling insurance with personal injury cover pays out if you suffer serious injuries in an accident. It can include hospital costs, broken bones, disability, or even loss of income while you recover.

How much is the cycling UK insurance price on average?

The price depends on your bike’s value, where you live, and how it is stored. On average, cycling UK insurance costs around £3–£10 per month for standard bikes and £15–£30 per month for e-bikes.

Which is the best cycling UK insurance?

The best cycling UK insurance is one that matches your riding needs. Look for a policy that covers theft, liability, and personal injury. One that also offers extras like worldwide cover or multi-bike discounts.

Does home insurance cover my bike?

Some home insurance policies include basic cover for bikes but mostly only while stored at home. Most would not protect your bike outdoors or during everyday use. A dedicated cycling policy is usually safer.

Is cycling insurance required by law in the UK?

No cycling insurance is not legally required in the UK. But theft rates and accident risks are high, so many cyclists choose it for protection and peace of mind.